Bearish Candle Patterns

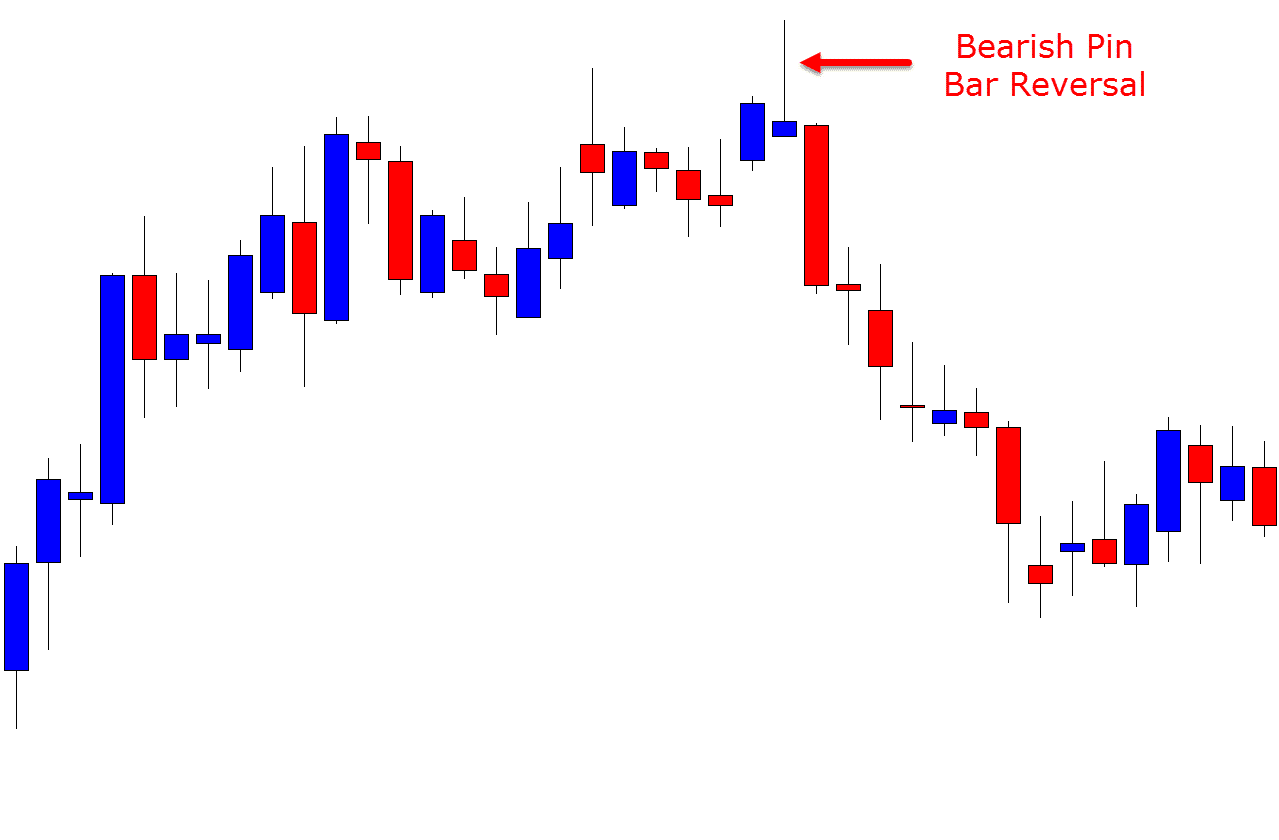

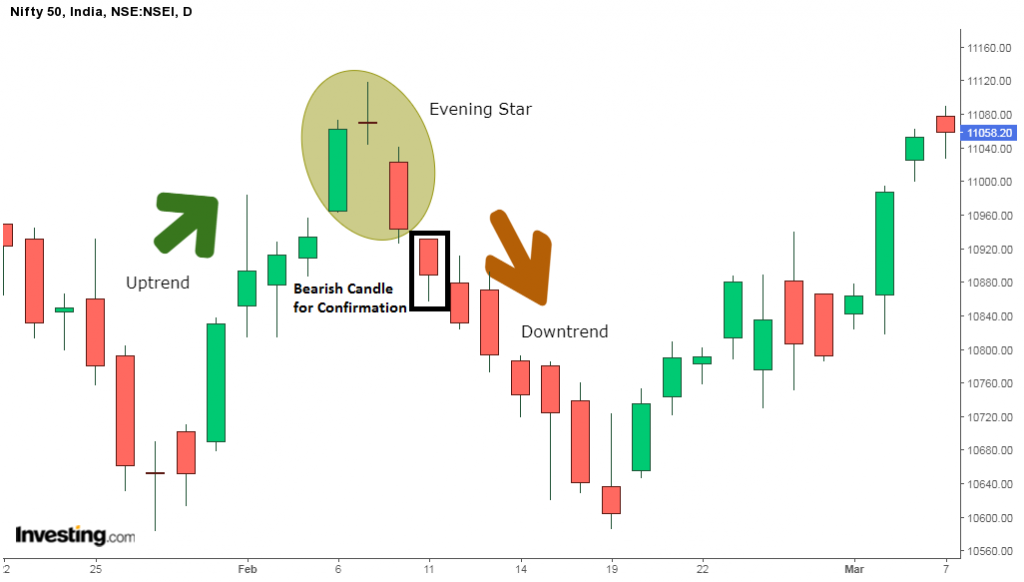

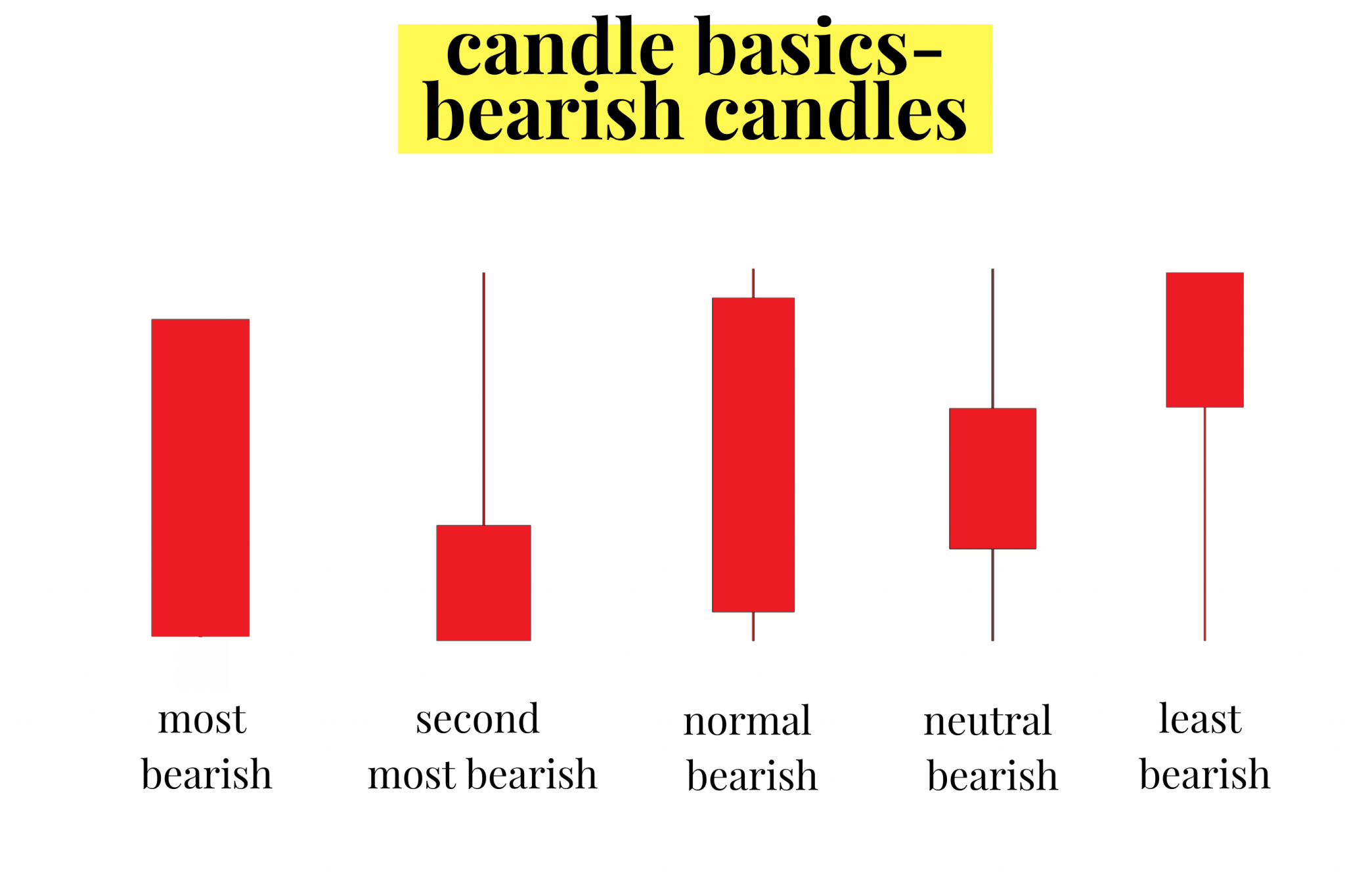

Bearish Candle Patterns - And a bearish reversal has higher probability reversing an uptrend. How can you tell if a candle is bearish? These patterns indicate that sellers may soon take control, pushing the. It saw a few green candles on its daily chart over the past week as it attempted to break above its. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Many of these are reversal patterns. Web let us look at the top 5 bearish candlestick patterns: Hedera’s [hbar] recent reversal from the $0.06 support level set the stage for the bulls to end their bearish rally. These patterns typically consist of a combination of candles with specific formations, each indicating a shift in market dynamics from buying to selling pressure. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Web bearish candlestick patterns. Web hbar’s long/short ratio indicated a slight bullish edge. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Web 8 strongest candlestick patterns. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. They are used by traders to time their entry and exit. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. It saw a few green candles on its daily chart over the past week as it attempted to break above its. Hedera’s [hbar] recent reversal from the $0.06 support level set the stage for the bulls to end their bearish rally. Many of these are reversal patterns. Check out or cheat sheet below and feel free to use it for your training! A breakout pierces the top line, resistance. What is the 3 candle rule in trading? Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Web hbar’s long/short ratio indicated a slight bullish edge. Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. These patterns differ in terms of candlestick arrangements, but they all convey a bearish bias. Short sellers and put options buyers are riding those prices down. Web bearish candlestick patterns. They typically. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web each candlestick tells a unique story. These patterns indicate that sellers may soon take control, pushing the. It saw a few green. When the market or a stock is bearish, the price goes down. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Their uniqueness and combinations hint at what may happen in the future. Candlestick patterns are technical trading formations that help visualize the price movement of a. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Traders use it alongside other technical indicators such as the relative strength index (rsi). Watching a candlestick pattern form can be time consuming and irritating. Web 5 powerful bearish candlestick patterns. Short sellers and put options buyers are riding. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Remember, the trend preceding the reversal dictates its potential: Many of these are reversal patterns. The “flagpole” is strongly bullish, with higher highs and higher. A breakout pierces the top line, resistance. These patterns differ in terms of candlestick arrangements, but they all convey a bearish bias. Web let us look at the top 5 bearish candlestick patterns: The “flagpole” is strongly bullish, with higher highs and higher lows; Web hbar’s long/short ratio indicated a slight bullish edge. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web 8 strongest candlestick patterns. When the market or a stock is bearish, the price goes down. Web bearish candlestick patterns. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as. The second day’s candle would completely engulf the body of the first day’s candle. A breakout pierces the top line, resistance. Short sellers and put options buyers are riding those prices down. Remember, the trend preceding the reversal dictates its potential: They are used by traders to time their entry and exit. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. They are used by traders to time their entry and exit. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web 5. And a bearish reversal has higher probability reversing an uptrend. The first candle is bullish in the pattern, signaling the continuation of the underlying uptrend. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). At no.1 we are going with a bearish reversal pattern very useful and easy to spot in the bullish markets. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web 8 strongest candlestick patterns. Web learn about all the trading candlestick patterns that exist: Web each candlestick tells a unique story. Being a trend reversal pattern, it occurs when the prices are in an uptrend but buyers are losing momentum. Web hbar’s long/short ratio indicated a slight bullish edge. To that end, we’ll be covering the fundamentals of. Web this strategy utilizes bollinger bands and engulfing candle patterns to generate trading signals. Web 5 powerful bearish candlestick patterns. Trading without candlestick patterns is a lot like flying in the night with no visibility. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong.Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

"Bearish Candlestick Patterns for traders Ultimate Graphics" Poster

bearishreversalcandlestickpatternsforexsignals Candlestick

What are Bearish Candlestick Patterns

Bearish Reversal Candlestick Patterns The Forex Geek

5 Powerful Bearish Candlestick Patterns

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns Explained New Trader U

Bearish Candlestick Patterns PDF Guide Free Download

Web The Shooting Star, Hanging Man Pattern, And Bearish Engulfing Are Common Bearish Candles.

Web Bearish Candlestick Patterns.

Strong Candlestick Patterns Are At Least 3 Times As Likely To Resolve In The Indicated Direction (Greater Than Or Equal To 75% Probability).

They Typically Tell Us An Exhaustion Story — Where Bulls Are Giving Up And Bears Are Taking Over.

Related Post: