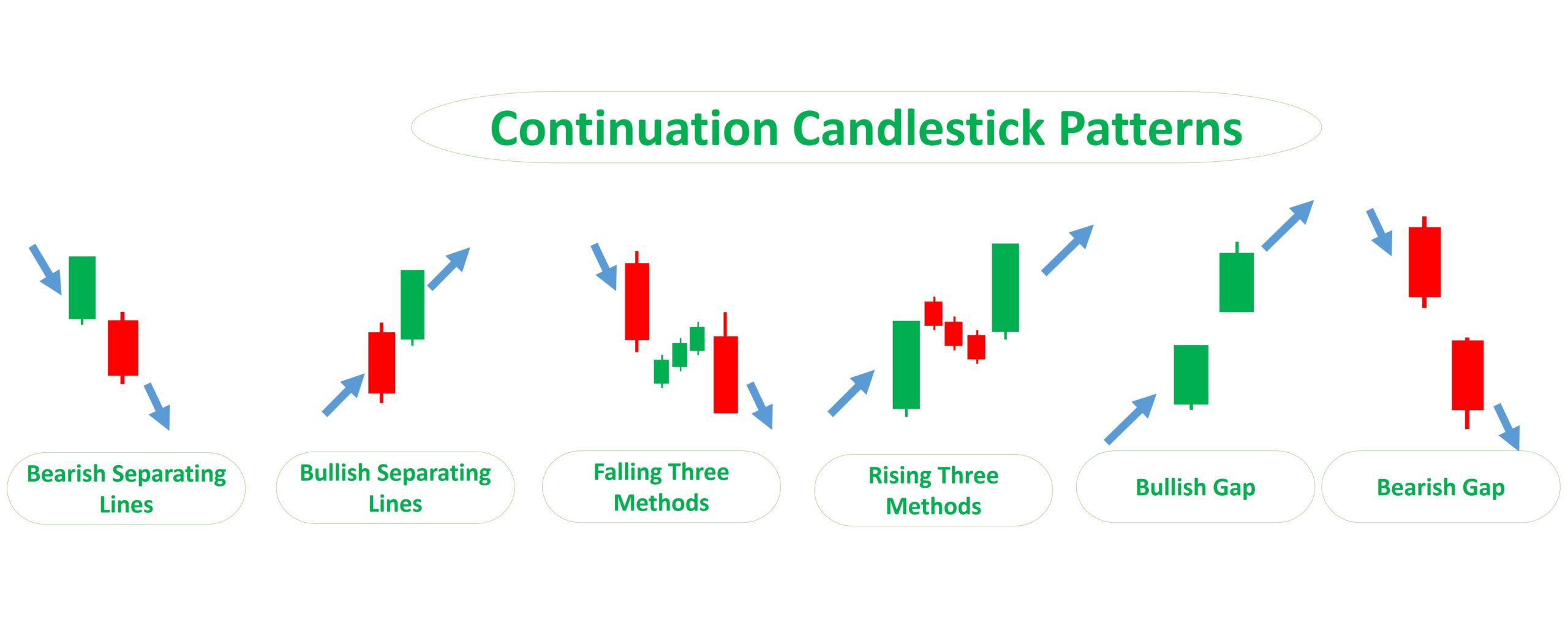

Continuation Candlestick Patterns

Continuation Candlestick Patterns - Web some common continuation candlestick patterns include the rising three methods, falling three methods, bullish flag, bearish flag, and pennant. Web a mat hold pattern is a candlestick formation indicating the continuation of a prior trend. Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. Continuation candlestick patterns signify the market is likely to continue trading in the same direction. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. Bearish continuation patterns appear midway through a downtrend and are easily identifiable. Let’s break down the basics: The body represents the opening and closing prices; These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Web here are a few commonly observed bullish continuation candlestick patterns: Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Web continuation candlestick patterns. The next candle opens lower and closes lower than the previous one. Web four continuation candlestick patterns. Wednesday and ended the session at lows, forming what many. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. These can help traders to identify a period of rest in the market, when there is. Continuation of an uptrend upside tasuki gap. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. Web the continuation candlestick pattern signals a prevailing trend once the breakout is confirmed and after a temporary trading pause in the market. So here are 4 continuation patterns you should know: There can be either bearish or bullish mat hold patterns. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. Each candlestick represents a specific period of time (e.g., one hour, one day, one week) and consists of a body and wicks or shadows.. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Web japanese candlestick bullish continuation patterns that tend to resolve in the same direction as the prevailing trend. Let’s break down the basics: Web candlestick patterns are graphic representations of the actions between supply and demand in the. Web bearish japanese candlestick continuation patterns are displayed below from strongest to weakest. Web continuation candlestick patterns. Web 4.5 top 3 continuation candlestick patterns. Each candlestick represents a specific period of time (e.g., one hour, one day, one week) and consists of a body and wicks or shadows. It’s the opposite of price reversal points, as they indicate the likelihood. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. Web the continuation candlestick pattern signals a prevailing trend once the breakout is confirmed and after a temporary trading pause in the market. Web understanding gaps is helpful for the reliable bullish continuation candlestick patterns that i’ll be sharing in this article. This. If a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. It shows the difference between the opening and closing prices. Web article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by internationally known author and trader thomas bulkowski. Continuation candlestick patterns signify the. A bullish pattern begins with a large bullish candle followed by a gap higher. Web bearish continuation candlestick patterns. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Continuations tend to resolve in the same direction as the prevailing trend: Web below you can find the schemes and explanations of the most. Web some common continuation candlestick patterns include the rising three methods, falling three methods, bullish flag, bearish flag, and pennant. Web 4.5 top 3 continuation candlestick patterns. Our goal is to look at the structure of these patterns, how they work, what the message that they are sending is, and share a simple but effective trading strategy based on the. Recognizing these patterns can provide valuable entry points and confirm the ongoing direction of price movements. Web continuation candlestick patterns. Basic components of a candlestick. These patterns suggest that the current trend is likely to continue. Web some common continuation candlestick patterns include the rising three methods, falling three methods, bullish flag, bearish flag, and pennant. There are dozens of different candlestick patterns with intuitive, descriptive. The thick part of the candle. Web the form and traits of successive candlesticks within a trend can be used to identify continuation candlestick patterns. Bearish continuation patterns appear midway through a downtrend and are easily identifiable. Wednesday and ended the session at lows, forming what many. A bullish pattern begins with a large bullish candle followed by a gap higher. Basic components of a candlestick. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. Continuation candlestick patterns signify the market is likely to continue trading in the same direction. Web the form and traits of successive candlesticks within. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Web japanese candlestick bullish continuation patterns that tend to resolve in the same direction as the prevailing trend. The different intensity of these trends can usually be noted in the following ways: The thick part of the candle. Web 4.5 top 3 continuation candlestick patterns. Traders use these different patterns in studying participation in the market on the side of the demand or supply. Each candlestick represents a specific period of time (e.g., one hour, one day, one week) and consists of a body and wicks or shadows. And if you’re a trend trader, these candlestick patterns present some of the best trading opportunities out there. The next candle opens lower and closes lower than the previous one. Web here are some tips to help you read candlestick charts. Web below you can find the schemes and explanations of the most common continuation candlestick patterns. There can be either bearish or bullish mat hold patterns. The body represents the opening and closing prices; So here are 4 continuation patterns you should know: These patterns suggest that the current trend is likely to continue. Let’s break down the basics:Popular Candlestick Patterns and Categories TrendSpider Learning Center

Continuation Pattern Meaning, Types & Working Finschool

Bearish Continuation Candlestick Patterns

Continuation Candlestick Patterns Cheat Sheet

Continuation Candlestick Patterns Cheat Sheet

Continuation Candlestick Patterns Cheat Sheet

Continuation Pattern Meaning, Types & Working Finschool

FOUR CONTINUATION CANDLESTICK PATTERNS YouTube

CANDLESTICK PATTERNS LEARNING = LIVING

Continuation Candlestick Patterns Cheat Sheet

These Can Help Traders To Identify A Period Of Rest In The Market,.

A Bullish Candle Forms After A Gap Up From The Previous White Candle.

Web Bearish Japanese Candlestick Continuation Patterns Are Displayed Below From Strongest To Weakest.

The Wicks Show The Highest And Lowest Prices During That Period.

Related Post: