Morning Star Pattern Candlestick

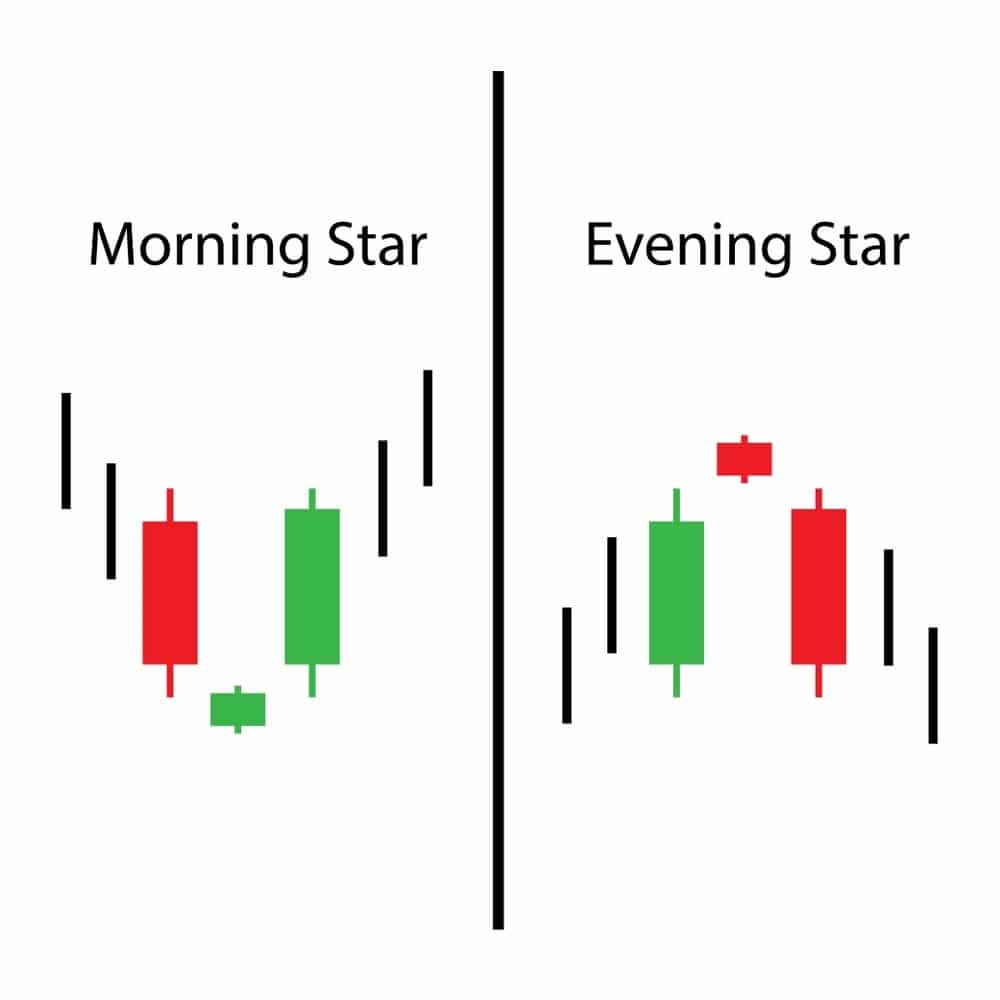

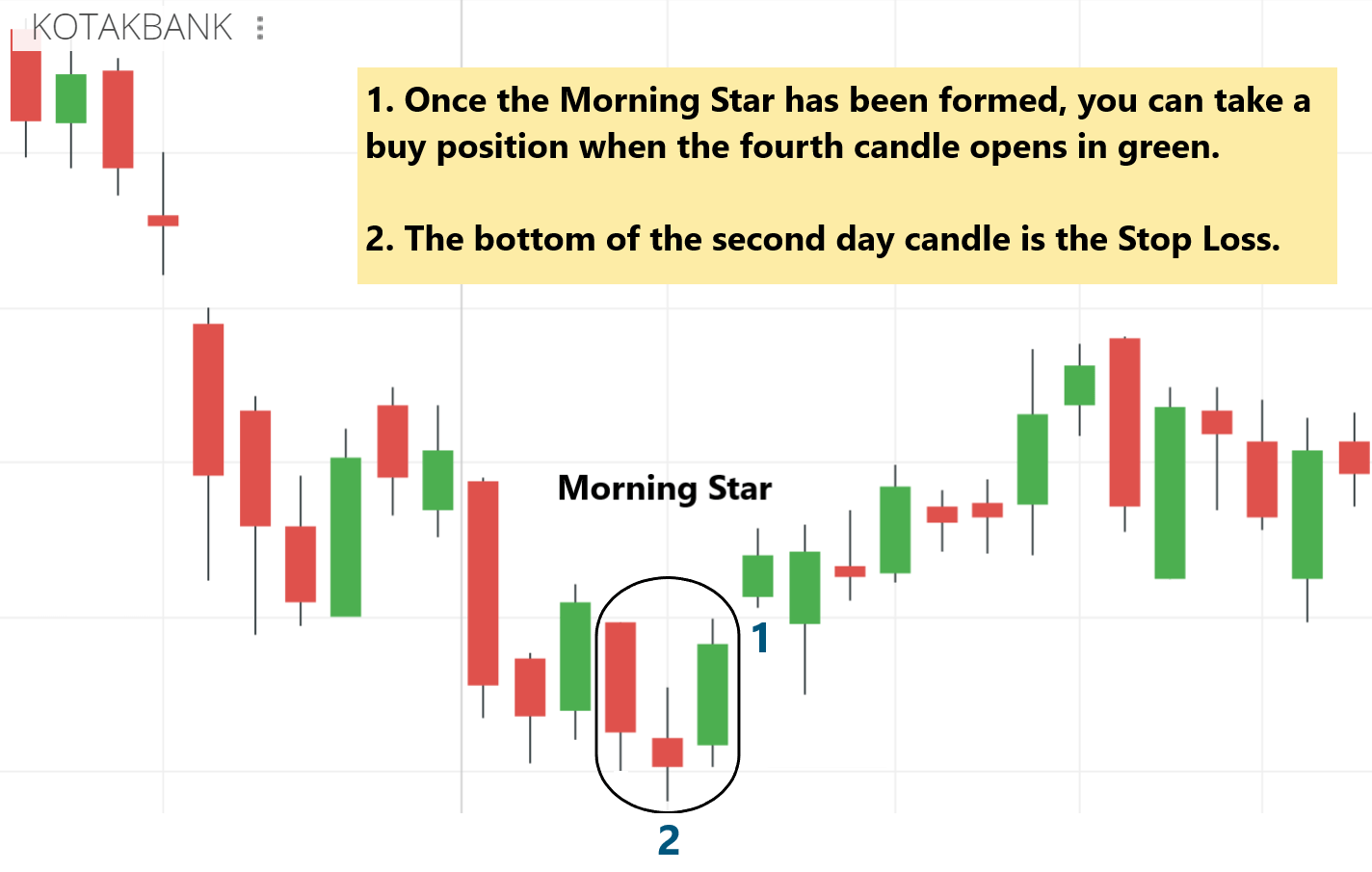

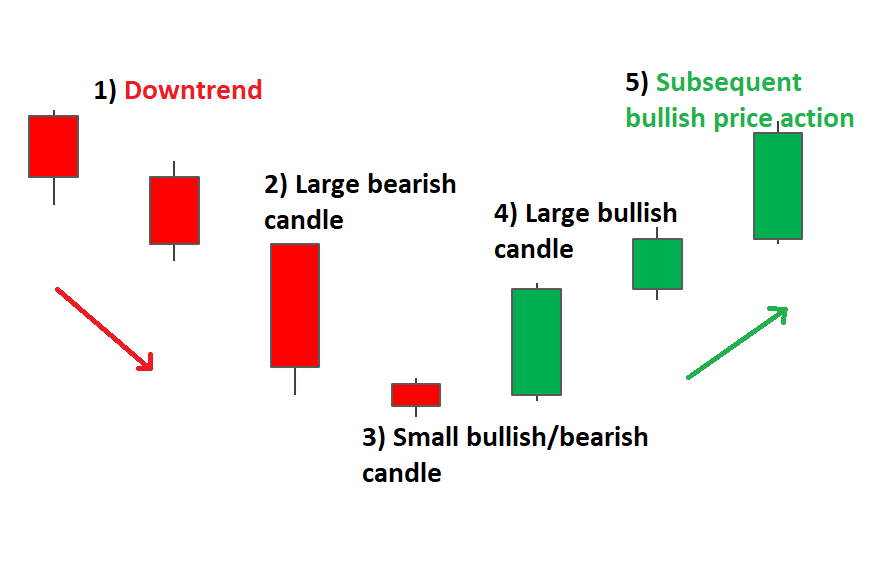

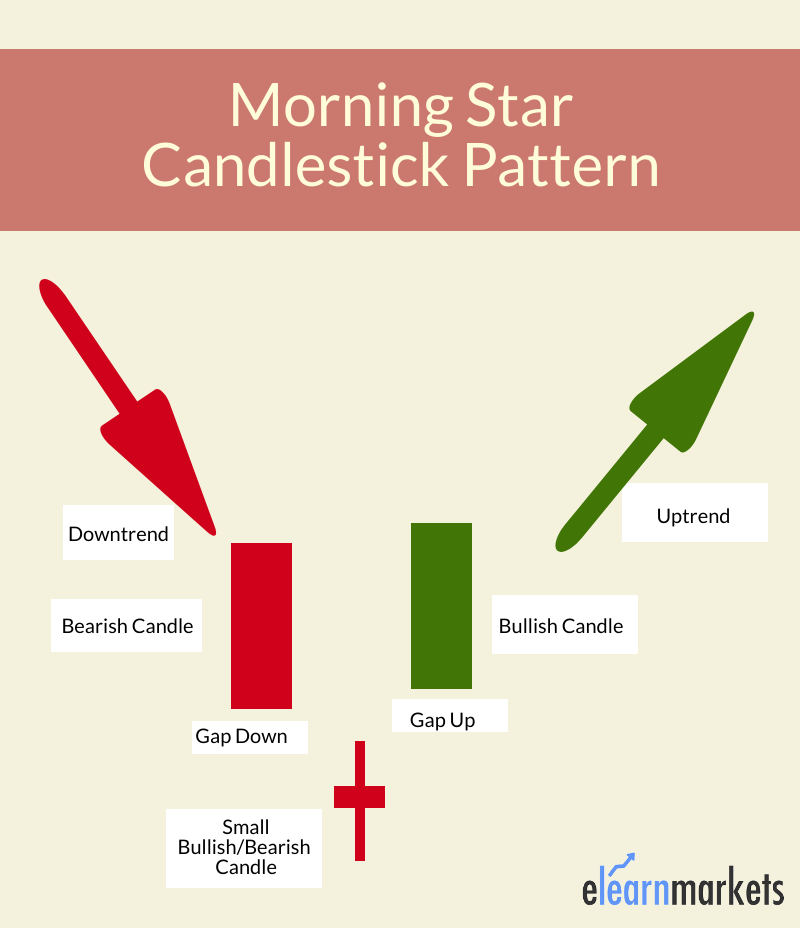

Morning Star Pattern Candlestick - This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Web morning and evening star reversal patterns: Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. It may appear during a downtrend and is made up of a large bearish candle followed by a short candle and a large bullish candle. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. Many other combinations of candlesticks make up valuable patterns, and i encourage seeking them out on your charts to help understand the stories they are telling you! Web the morning star is a candlestick pattern that is comprised of three candles. Web a security firm's tolerance or lack of tolerance of ethical misdeeds, and the leadership's philosophy of business, convey a great deal throughout the organization. Typically, the 3rd candle forms a bullish reversal pattern. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. Correctly spotting reversals is crucial when. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Web a security firm's tolerance or lack of tolerance of ethical misdeeds, and the leadership's philosophy of business, convey a great deal throughout the organization. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Web consisting of three candlesticks, morning star candlestick patterns generate bullish trading signals that can be used when establishing long positions in financial markets. It provides examples of common bullish formations like bullish engulfing and morning star, and bearish formations such as bearish engulfing and evening star. Web the morning star candlestick pattern is a price action analysis tool used to identify potential trend reversals on the price charts. Web 2005 morning star dr, clermont, fl 34714. Web the morning star is a candlestick pattern that is comprised of three candles. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. The first line is any black candle appearing as a long line in an uptrend: Web. The morning star can also occur without a body. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. It consists of a bearish candle, a short doji that. The pattern consists of three candlesticks: The 1st candle is bearish, the 2nd is a spinning top or doji , and the 3rd is a bullish candlestick. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. It may appear during a downtrend and is made up of a large. Correctly spotting reversals is crucial when. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web <<strong>strong</strong>>cosmic patterns convergence 2025</strong>. Web a morning star pattern consists of three candlesticks that form near support levels. The first candlestick drops with a gap down, followed by the third candlestick,. Oil and gas giant conocophillips ( cop) appears to be forming a morning star pattern. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. This pattern is composed of three candlesticks, with the first one being a tall. Two large ones with different directions and a smaller candlestick between them. Web the morning star is a reversal candlestick pattern that signals a potential trend change from downside to upside movement. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. This candlestick formation may symbolize. The first candlestick drops. The first line is any black candle appearing as a long line in an uptrend: Web what is a morning star candlestick pattern? Two large ones with different directions and a smaller candlestick between them. Web the morning star candlestick pattern is a price action analysis tool used to identify potential trend reversals on the price charts. The morning star. A completed morning star formation indicates a new bullish sentiment in the market. Using candlestick patterns with key areas of value—such as support and resistance levels, trendlines, and moving. The morning star candlestick forms at the bottom of a stock’s price decline and suggests a downtrend may be nearing its end. It provides examples of common bullish formations like bullish. Web consisting of three candlesticks, morning star candlestick patterns generate bullish trading signals that can be used when establishing long positions in financial markets. The 1st candle is bearish, the 2nd is a spinning top or doji , and the 3rd is a bullish candlestick. Short sale has been approved by the bank, pool/spa home! Web by josh enomoto, investorplace. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. The 1st candle is bearish, the 2nd is a spinning top or doji , and the 3rd is a bullish candlestick. Web a morning star pattern consists of three candlesticks that form near support levels. Web the morning star is a candlestick with a. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web a morning star pattern consists of three candlesticks that form near support levels. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. The morning star can also occur without a body. Web morning star candlestick is a triple candlestick pattern that indicated bullish reversal. It provides examples of common bullish formations like bullish engulfing and morning star, and bearish formations such as bearish engulfing and evening star. Web bullish candlesticks indicate an upward trend and buying pressure, while bearish candlesticks signal a downward trend and selling pressure. A completed morning star formation indicates a new bullish sentiment in the market. It may appear during a downtrend and is made up of a large bearish candle followed by a short candle and a large bullish candle. It typically forms after a downward trend, telling us it is the start of an upward climb and indicating a reversal in the previous price trend. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. The first line is any black candle appearing as a long line in an uptrend: Since the days of the treadway commission, and enforcement cases before it, we have preached the importance of this tone from the top. No matter your astrological experience or knowledge level, you're warmly invited to the conference, where you're bound to find enjoyment.Morning Star Candlestick Pattern

Best candlestick patterns morning star candlestick pattern

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

Morning Star Candle Stick Pattern

Morning Star Candlestick Pattern definition and guide

Morning Star Candlestick A Forex Trader’s Guide

How To Trade Blog What Is Morning Star Candlestick Pattern? How To Use

Understanding The Morning Star Candlestick Pattern InvestoPower

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

What Is Morning Star Candlestick? Formation & Uses ELM

Web A Morning Star Is A Bullish Visual Pattern In Technical Analysis With Three Candlesticks.

Web What Is A Morning Star Candlestick Pattern?

Web The Morning Star Is A Candlestick With A Small Body That Forms At The Bottom Of The Downtrend And Signals An Upward Trend Reversal.

The Morning Star Candlestick Forms At The Bottom Of A Stock’s Price Decline And Suggests A Downtrend May Be Nearing Its End.

Related Post: