Tweezer Bottom Pattern

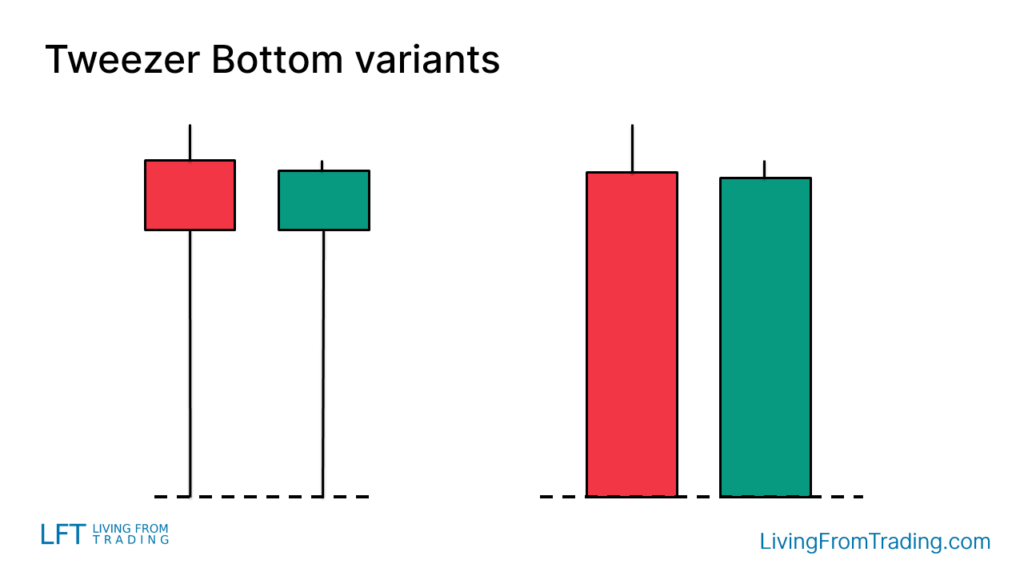

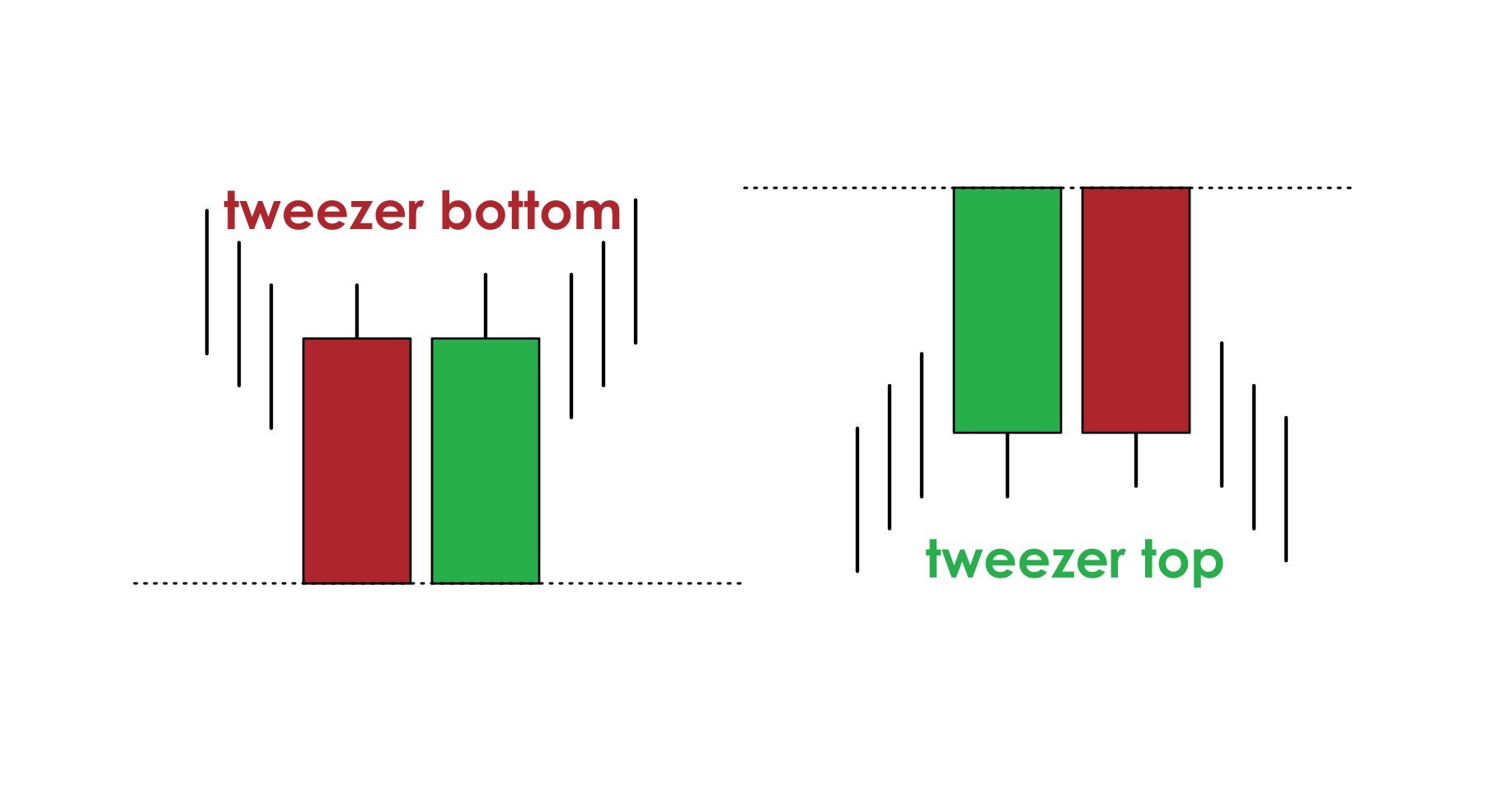

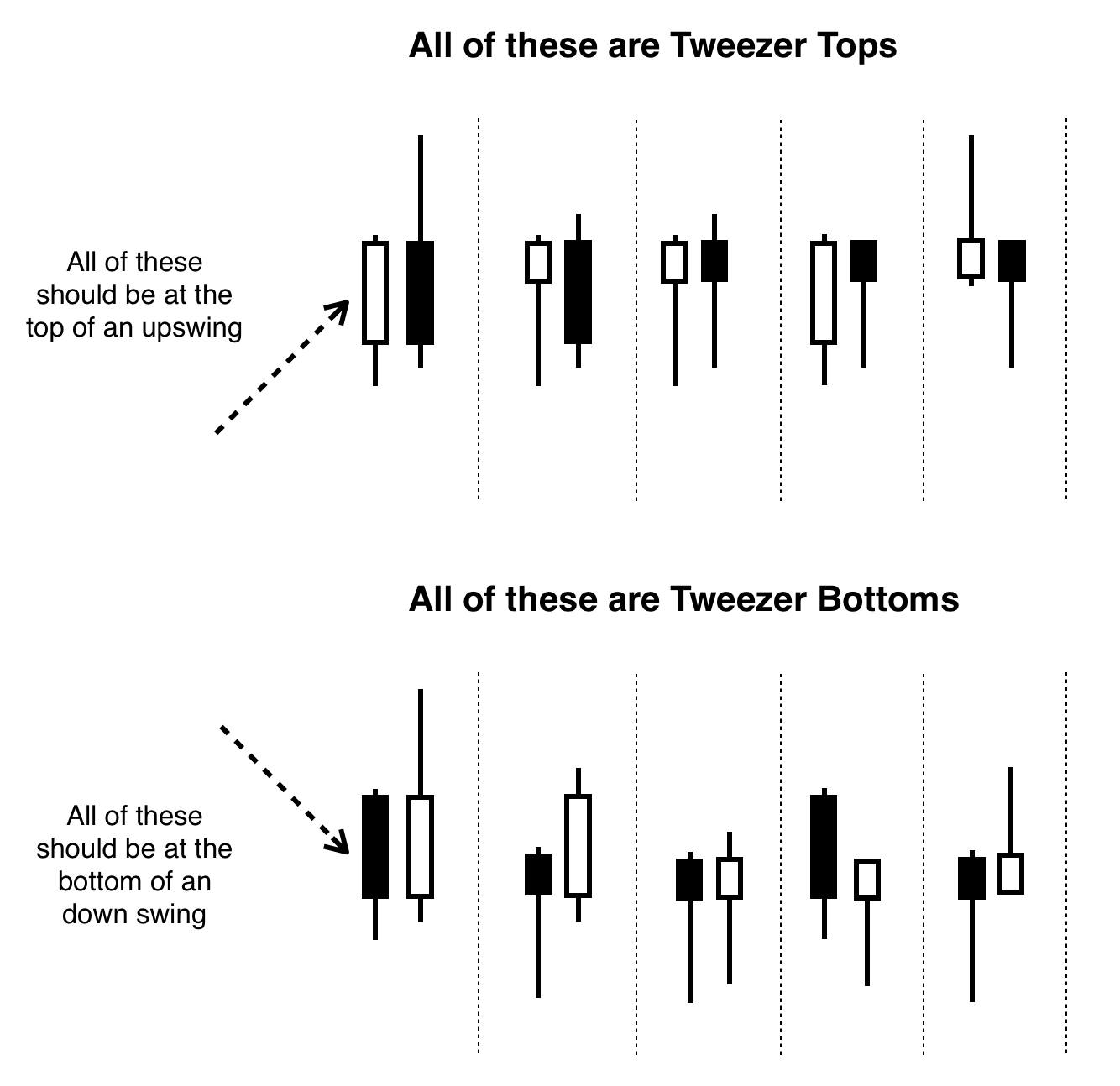

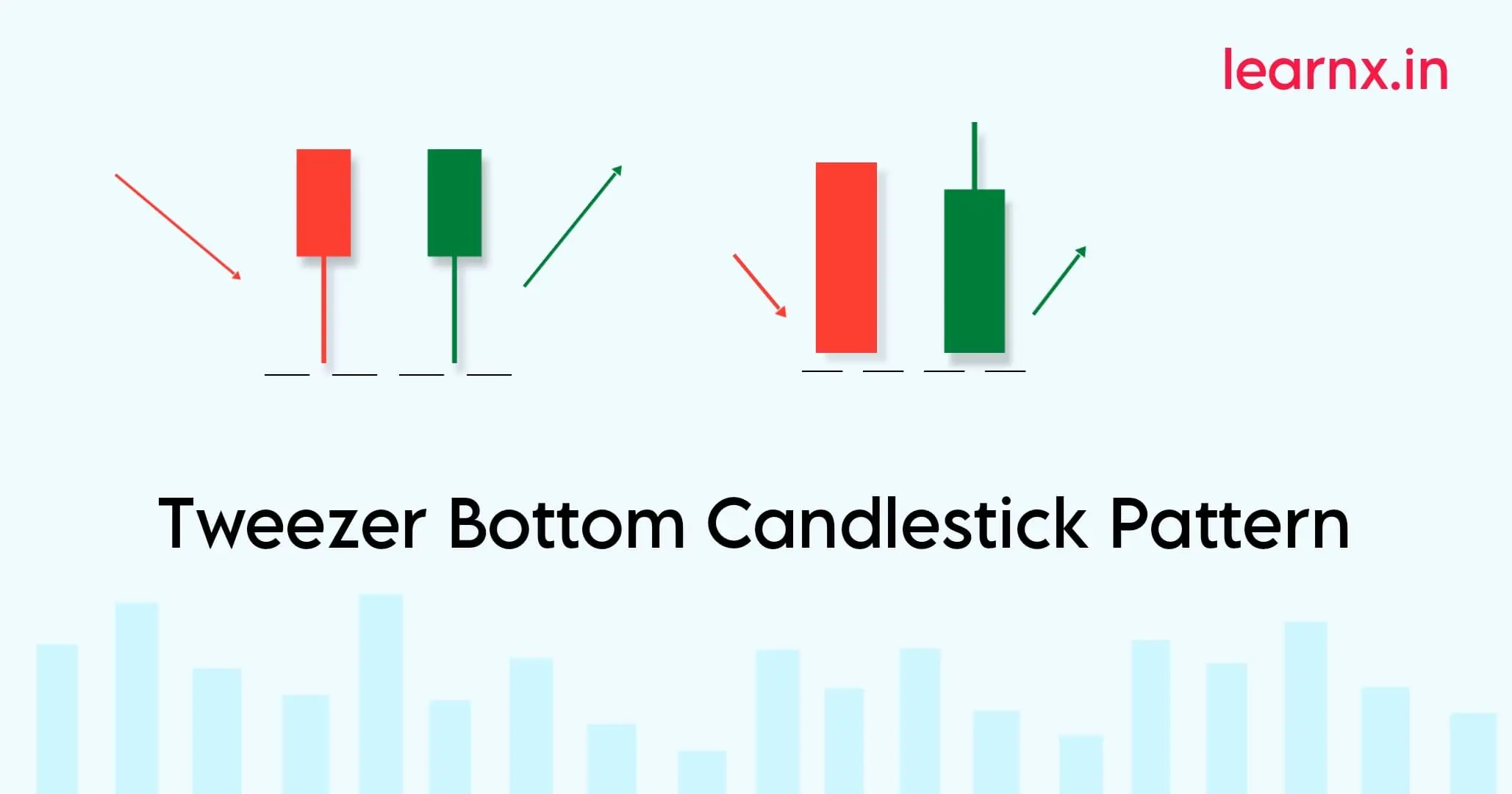

Tweezer Bottom Pattern - Despite your best efforts it can. Both formations will have two candles that develop at the end of a trend. The first candle is long and red, the second candle is green, its lows nearly identical to the low of the previous candle. The pattern is bullish because we expect to have a bull move after the. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. Web learn all about the tweezer bottom pattern and how to identify and trade bullish reversals in stock trading. Successful bottom painting is dependent on several important factors including thorough preparation and repairs of all surfaces, extensive knowledge of primers and antifoulings and their applications. Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. Web the tweezer bottom, also known as tweezers, is a reversal candlestick pattern that signals potential changes in the direction of the price. Web what is the tweezer bottom pattern & its importance? Web hartung et al. Web tweezer bottom pattern is a candlestick formation indicating potential bullish reversal, formed by two candlesticks with lows, followed by upward movement. It consists of two candlesticks and indicates a bullish reversal in a chart. It consists of two candlesticks, the first one being bearish and the. The pattern is more important when there is a strong shift in momentum between the first candle and. Web a tweezer is a technical analysis pattern, commonly involving two candlesticks, that can signify either a market top or bottom. The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. It consists of two candlesticks with equal lows, one appearing immediately after the other. The first candle is long and red, the second candle is green, its lows nearly identical to the low of the previous candle. The matching bottoms are usually composed of shadows (or wicks) but can be the candle’s bodies as well. The tweezer bottom pattern indicates that the selling pressure has been exhausted, and buyers are stepping in. The pattern is a bullish reversal candlestick formation that signals a possible end to a downtrend and the beginning of an uptrend it is identified by two or more consecutive candlesticks with matching bottom prices that appear at the end of a bearish. The matching bottoms are usually composed of shadows (or wicks) but can be the candle’s bodies as well. The tweezer top candlestick pattern. Web a tweezer bottom is a candlestick pattern that forms during a bearish trend reversal, typically consisting of two or more candles. Web in 1925, the black bottom house of prayer was constructed as the home of. It consists of two candlesticks with equal lows, one appearing immediately after the other. Web the tweezer bottom, also known as tweezers, is a reversal candlestick pattern that signals potential changes in the direction of the price. The pattern is more important when there is a strong shift in momentum between the first candle and. Qb quilts provides quality longarm. Usually, it appears after a price decline and shows rejection from lower prices. Or take inspiration from other projects i've done: Web tweezer top and bottom, also known as tweezers, are reversal candlestick patterns that signal a potential change in the price direction. It consists of two candlesticks with equal lows, one appearing immediately after the other. The pattern is. 35% sun 21 | day. It consists of two candlesticks and indicates a bullish reversal in a chart. Web what is the tweezer bottom pattern? The easiest way to visualize the tweezer bottom is by thinking of it as a shift in momentum. Web hartung et al. Or take inspiration from other projects i've done: Web a tweezers bottom occurs when two candles, back to back, occur with very similar lows. The tweezer top candlestick pattern. It consists of two candlesticks, the first one being bearish and the. The pattern is bullish because we expect to have a bull move after the. 35% sun 21 | day. It consists of two candlesticks, the first one being bearish and the. The matching bottoms are usually composed of shadows (or wicks) but can be the candle’s bodies as well. The tweezer bottom candlestick pattern is a bullish reversal candlestick pattern that is formed at the end of the downtrend. Web a tweezers bottom occurs. The pattern is bullish because we expect to have a bull move after the. Be a real challenge to find. Web what does tweezer bottom pattern indicate? The pattern is a bullish reversal candlestick formation that signals a possible end to a downtrend and the beginning of an uptrend it is identified by two or more consecutive candlesticks with matching. The tweezer top pattern is a bearish reversal pattern that consists of two candles. Both formations will have two candles that develop at the end of a trend. Demonstrate the ability to load rubidium atoms into an optical lattice placed in an optical cavity. 35% sun 21 | day. Both formations consist of two candles that occur at the end. Increasing clouds with periods of showers this afternoon. Successful bottom painting is dependent on several important factors including thorough preparation and repairs of all surfaces, extensive knowledge of primers and antifoulings and their applications. Both formations consist of two candles that occur at the end of a trend, which is in its dying stages. This guide provides essential information for. 35% sun 21 | day. It occurs when the market defends a low point, indicating a potential bullish reversal. Web tweezer bottom pattern is a candlestick formation indicating potential bullish reversal, formed by two candlesticks with lows, followed by upward movement. The pattern is bullish because we expect to have a bull move after the. Web the tweezer bottom is a japanese candlestick pattern. Qb quilts provides quality longarm quilting services. Web a tweezer bottom is a bullish reversal pattern seen at the bottom of downtrends and consists of two japanese candlesticks with matching bottoms. The matching bottoms are usually composed of shadows (or wicks) but can be the candle’s bodies as well. It is recognized by the presence of two or more consecutive candlesticks with matching bottom prices. Both formations will have two candles that develop at the end of a trend. The tweezer top pattern is a bearish reversal pattern that consists of two candles. It consists of two candlesticks and indicates a bullish reversal in a chart. The pattern is more important when there is a strong shift in momentum between the first candle and. This pattern can be seen as a reversal in a downtrend. Increasing clouds with periods of showers this afternoon. This guide provides essential information for both beginner and experienced traders, including how to spot the pattern and.Tweezer Bottom Candlestick Pattern What Is And How To Trade Living

Tweezer Bottom Candlestick Pattern Meaning & Importance Finschool

What Are Tweezer Tops & Tweezer Bottoms? Meaning And How To Trade

How To Trade Blog What Are Tweezer Tops And Tweezer Bottoms? Meaning

Learn About Tweezer Candlestick Patterns Today ThinkMarkets

Bottom Candlestick Patterns

Tweezer Bottom Patterns How To Trade Them Easily

How to Interpret the Tweezer Candlestick Pattern • TradeSmart University

Tweezer Bottom Candlestick Pattern Explained LearnX

Tweezer Bottom Candlestick Trading For Beginners InfoBrother

It Consists Of Two Candlesticks, The First One Being Bearish And The.

Web The Tweezer Bottom, Also Known As Tweezers, Is A Reversal Candlestick Pattern That Signals Potential Changes In The Direction Of The Price.

Web A Tweezer Bottom Pattern Consists Of Two Candlesticks Forming Two Valleys Or Support Levels With Equal Bottoms.

Web The Tweezer Bottom Pattern Is A Candlestick Pattern That Every Trader Should Have In Their Toolbox.

Related Post: